SHELTON, CONNECTICUT / ACCESS Newswire / November 17, 2025 / NanoViricides, Inc. (NYSE Amer.:NNVC) (the “Company”), reports that it has filed its Quarterly Report on Form 10-Q for the fiscal quarter ending September 30, 2025 with the Securities and Exchange Commission (SEC) on Friday, November 14, 2025. The report can be accessed at the SEC website (https://www.sec.gov/Archives/edgar/data/1379006/000110465925112608/nnvc-20250930x10q.htm).

Clinical Stage NV-387, a Single Drug, Meets Many Unmet Medical Needs in Viral Diseases

NV-387, based on a novel mechanism of action, and a novel nanomedicine technology that defines a new class of drugs, is a first-in-class broad-spectrum antiviral drug.

Viruses cannot escape NV-387 because no matter how much a virus changes, it continues to bind to the sulfated proteoglycan attachment receptor(s) of the host which the virus needs to cause infection as well as for human-to-human transmission. NV-387 mimics the critical features of the conserved attachment receptors on the host-side that over 90% of viruses are known to use.

This escape-resistant drug feature of NV-387 solves the biggest problem in antiviral medical countermeasures: Viruses readily evolve to escape the countermeasures in the field, whether vaccines, antibodies, or traditional small chemical drugs.

At present:

-

There is no approved drug for Influenza that can be reliably predicted to be not escaped by the next potential epidemic or pandemic Influenza virus, including H5N1. All approved influenza drugs are known to be readily escaped by Influenza variants.

-

Additionally, in the current season, the mutated clade K of the A/H3N2 subtype is dominant in the Northern hemisphere, and the seasonal Influenza vaccine is “mismatched” (i.e. it contains the older variant, clade J, of A/H3N2). When the vaccine is mismatched, the overall vaccine efficacy as determined post-season has been as low as 11-17% [1] .

-

There is no approved drug for RSV, although three different antibodies have been approved for pre-exposure protection of infants from potential risk of RSV infection, and some vaccines have been approved for use in geriatric patients and adults at risk, as well as for pregnant women. While the market size is projected to be exceeding $8 billion or so, the regulatory development timelines are long for RSV pediatric drug development.

-

There is no approved drug for Measles.

-

There is no approved drug for MPox.

-

The Smallpox approved drugs (under FDA Animal Rule) have significant shortcomings, leaving the US practically unprepared for this bioterrorism scenario despite several billions of dollars in development and acquisitions.

-

The approved drugs for Influenza are unlikely to meet the challenge of an H5N1 or highly pathogenic influenza virus epidemic.

NV-387, based on relevant animal model studies, and based on safety and tolerability observed in a Phase I human clinical trial, can fulfill these glaring gaps in pandemic preparedness for current and emerging threats, as well as for potential bioterrorism threats.

Thus, NV-387, as a single drug, is responding to several unmet medical needs in viral infectious diseases at once.

Current Quarter Developments

During the current quarter, we have diligently continued our progress towards initiating a Phase II human safety and effectiveness clinical trial for the evaluation of NV-387 as a treatment of Monkeypox in the Democratic Republic of Congo.

The local regulatory agency, ACOREP, has already approved this Phase II clinical trial, subject to completion of certain requirements.

Africa continues to suffer from the Monkeypox epidemic, which has resulted in the Africa CDC declaring in August 2024 a “Public Health Emergency of Continental Security” (PHECS), a status that continues because this epidemic has continued to expand across national boundaries. This Mpox epidemic is driven by the more morbid and more virulent versions, Clade 1a and 1b, as compared to the 2022 outbreak that was driven by the less virulent Clade 2. The latter has become endemic in the USA and the Western World, but remains limited to sexual transmission primarily in the men-having-sex-with-men (MSM) population. The case fatality rate of Clade 1 has been between 9% to 1.5%, whereas that of Clade 2 is less than 0.3%.

Our objective is to bring the data from the clinical trials external to the USA and utilize it for further regulatory advancement of NV-387 against various indications under the US FDA. NV-387 has certain orphan disease as well as bioterrorism related indications.

Therefore, we first plan to file the appropriate Orphan Drug Designations (ODD) for NV-387 as a treatment for MPOx, Smallpox, and also for Measles. The ODD if approved provides several benefits that would accelerate the NV-387 program towards regulatory licensure. These include frequent FDA meetings and rapid decision-making. Additionally, the economic benefits include certain tax credits for R&D costs, waiver of certain PDUFA fees, and a seven year exclusivity for marketing the drug for the licensed indication.

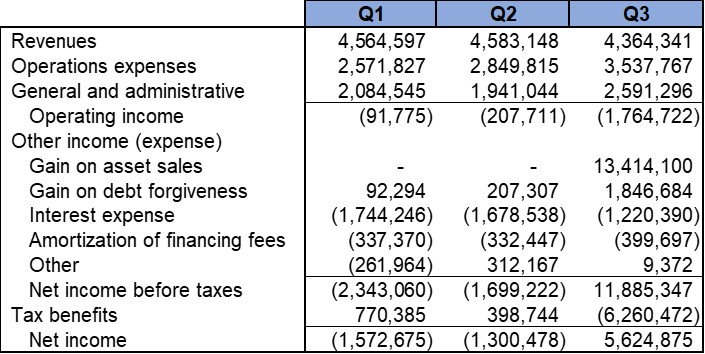

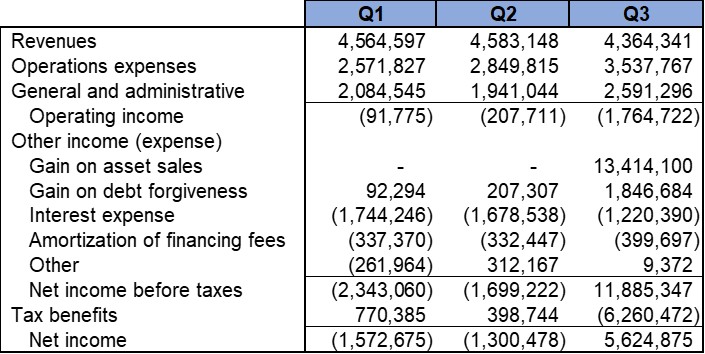

Company Financials

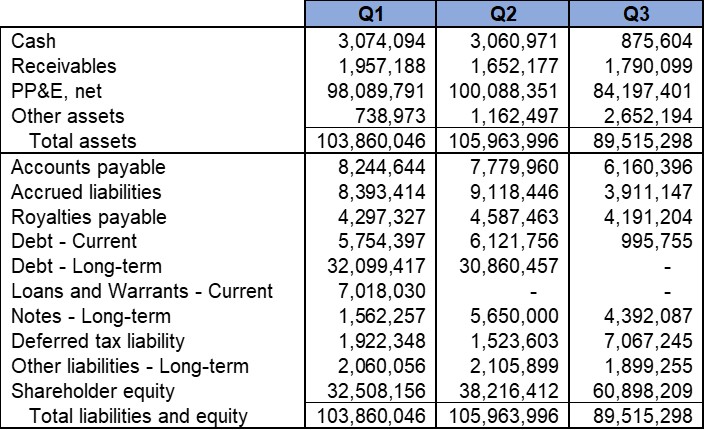

We reported that, as of September 30, 2025, we had cash and cash equivalent current assets balance of approximately $1.25 Million. In addition, we reported approximately $8.36 Million in total Assets including $6.78 Million of Net Property and Equipment (P&E) assets (after depreciation). The strong P&E assets comprise our cGMP-capable manufacturing and R&D facility in Shelton, CT. The total current liabilities were approximately $1.18 Million.

The net cash utilized during the three months ended September 30, 2025 was approximately $1.59 Million. This included certain non-recurring expenditures including R&D expenditures in preparation for a Phase II clinical trial application. We raised approximately $1.25 Million net of commission and certain expenses in an At-the-Market offering (“ATM”) during the three months ended September 30, 2025.

Additionally, subsequent to the reporting period, we raised approximately $0.68 million in the said ATM offering from October 1 through November 4, 2025.

Further, on November 10, 2025, we raised approximately $5.5 Million in cash after expenses and commissions, in a Registered Direct Offering (“RDO”) and a concurrent private placement offering (both together, the “Offering”) from a single institutional healthcare-focused investor. The overall Offering consisted of (i) 1,970,000 shares of common stock, par value $0.00001 per share (the “Common Stock”), at an offering price of $1.68 per share, and (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 1,601,429 shares of Common Stock, at an offering price of $1.67999 per Pre-Funded Warrant, in the RDO, and in the concurrent private placement with the same investor, the Company has issued and sold Series A warrants to purchase up to 3,571,429 shares of common stock (the “Series A Warrants”) and Series B warrants to purchase up to 3,571,429 shares of common stock (the “Series B Warrants” and, together with the Series A Warrants, the “Warrants”). The Series A Warrants will have an exercise price of $1.75 per share, will be exercisable after 6 months from date of issuance, and will expire 2 years following the issuance date. The Series B Warrants will have an exercise price of $2.00 per share, will be exercisable after 6 months from date of issuance, and will expire 5.5 years following the issuance date.

These financings have added cash amounts of approximately $6.1 million to the Company’s cash balance as of November 12, 2025. Additionally, we continue to have access to an available line of credit of $3 million provided by our founder and President Dr. Anil Diwan. Based on budgeting considerations, we reported that we do not have sufficient funding in hand to continue operations through February 14, 2026, for our planned objectives that include (i) a Phase II clinical trial of NV-387 for MPox infection in Central Africa, (ii) a Phase II clinical trial of NV-387 for Viral Acute and Severe Acute Respiratory Infections (V-ARI and V-SARI), and (iii) Preparation and pre-IND filing for a Phase II clinical trial of NV-387 for RSV indication in the USA.

We note that an additional gross cash financing of $6.25 Million would result into the Company if and when the Series A warrants are exercised. We also note that we continue to have access to the aforementioned ATM Equity Offering. Additionally, we believe we will have access to the equity markets to raise the funds necessary for our current objectives, as we meet various milestones in the ensuing year. We continue to re-prioritize our programs in line with available resources.

Thus we believe that our recent financings have substantially fortified the Company’s fiscal position, and we further believe that we have the ability to continue on our regulatory development plan for NV-387 including the Phase II MPox clinical trial, as well as various planned US FDA engagements for different indications.

We believe our regulatory developments for the orphan diseases and for bioterrorism agents response, provide for a rapid regulatory pathway for US FDA licensure of NV-387, with potential for non-dilutive grant and contracts funding, as well as possible direct US Government acquisition contracts worth hundreds of millions of dollars per year if NV-387 is approved for one of the agents that the US Government stockpiles drugs for. We believe that these early stage revenue opportunities would help us fuel the commercial drug development of NV-387 towards the tens of billions of dollars markets in RSV, Influenza, and other viral infections; as well as to further advance our NV-HHV-1 pan-herpesvirus drug candidate, among others.

About NanoViricides

NanoViricides, Inc. (the “Company”) (www.nanoviricides.com) is a clinical stage company that is creating special purpose nanomaterials for antiviral therapy. The Company’s novel nanoviricide™ class of drug candidates and the nanoviricide™ technology are based on intellectual property, technology and proprietary know-how of TheraCour Pharma, Inc. The Company has a Memorandum of Understanding with TheraCour for the development of drugs based on these technologies for all antiviral infections. The MoU does not include cancer and similar diseases that may have viral origin but require different kinds of treatments.

The Company has obtained broad, exclusive, sub-licensable, field licenses to drugs developed in several licensed fields from TheraCour Pharma, Inc. The Company’s business model is based on licensing technology from TheraCour Pharma Inc. for specific application verticals of specific viruses, as established at its foundation in 2005.

Our lead drug candidate is NV-387, a broad-spectrum antiviral drug that we plan to develop as a treatment of RSV, COVID, Long COVID, Influenza, and other respiratory viral infections, as well as MPOX/Smallpox infections, and even Measles. Our other advanced drug candidate is NV-HHV-1 for the treatment of Shingles. The Company cannot project an exact date for filing an IND for any of its drugs because of dependence on a number of external collaborators and consultants. The Company is currently focused on advancing NV-387 into Phase II human clinical trials.

NV-CoV-2 (API NV-387) is our nanoviricide drug candidate for COVID-19 that does not encapsulate remdesivir. NV-CoV-2-R is our other drug candidate for COVID-19 that is made up of NV-387 with remdesivir encapsulated within its polymeric micelles. The Company believes that since remdesivir is already US FDA approved, our drug candidate encapsulating remdesivir is likely to be an approvable drug, if safety is comparable. Remdesivir is developed by Gilead. The Company has developed both of its own drug candidates NV-CoV-2 and NV-CoV-2-R independently.

The Company is also developing drugs against a number of viral diseases including oral and genital Herpes, viral diseases of the eye including EKC and herpes keratitis, H1N1 swine flu, H5N1 bird flu, seasonal Influenza, HIV, Hepatitis C, Rabies, Dengue fever, and Ebola virus, among others. NanoViricides’ platform technology and programs are based on the TheraCour® nanomedicine technology of TheraCour, which TheraCour licenses from AllExcel. NanoViricides holds a worldwide exclusive perpetual license to this technology for several drugs with specific targeting mechanisms in perpetuity for the treatment of the following human viral diseases: Human Immunodeficiency Virus (HIV/AIDS), Hepatitis B Virus (HBV), Hepatitis C Virus (HCV), Rabies, Herpes Simplex Virus (HSV-1 and HSV-2), Varicella-Zoster Virus (VZV), Influenza and Asian Bird Flu Virus, Dengue viruses, Japanese Encephalitis virus, West Nile Virus, Ebola/Marburg viruses, and certain Coronaviruses. The Company intends to obtain a license for RSV, Poxviruses, and/or Enteroviruses if the initial research is successful. As is customary, the Company must state the risk factor that the path to typical drug development of any pharmaceutical product is extremely lengthy and requires substantial capital. As with any drug development efforts by any company, there can be no assurance at this time that any of the Company’s pharmaceutical candidates would show sufficient effectiveness and safety for human clinical development. Further, there can be no assurance at this time that successful results against coronavirus in our lab will lead to successful clinical trials or a successful pharmaceutical product.

This press release contains forward-looking statements that reflect the Company’s current expectation regarding future events. Actual events could differ materially and substantially from those projected herein and depend on a number of factors. Certain statements in this release, and other written or oral statements made by NanoViricides, Inc. are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond the Company’s control and which could, and likely will, materially affect actual results, levels of activity, performance or achievements. The Company assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Important factors that could cause actual results to differ materially from the company’s expectations include, but are not limited to, those factors that are disclosed under the heading “Risk Factors” and elsewhere in documents filed by the company from time to time with the United States Securities and Exchange Commission and other regulatory authorities. Although it is not possible to predict or identify all such factors, they may include the following: demonstration and proof of principle in preclinical trials that a nanoviricide is safe and effective; successful development of our product candidates; our ability to seek and obtain regulatory approvals, including with respect to the indications we are seeking; the successful commercialization of our product candidates; and market acceptance of our products.

The phrases “safety”, “effectiveness” and equivalent phrases as used in this press release refer to research findings including clinical trials as the customary research usage and do not indicate evaluation of safety or effectiveness by the US FDA.

FDA refers to US Food and Drug Administration. IND application refers to “Investigational New Drug” application. cGMP refers to current Good Manufacturing Practices. CMC refers to “Chemistry, Manufacture, and Controls”. CHMP refers to the Committee for Medicinal Products for Human Use, which is the European Medicines Agency’s (EMA) committee responsible for human medicines. API stands for “Active Pharmaceutical Ingredient”. WHO is the World Health Organization. R&D refers to Research and Development.

Contact:

NanoViricides, Inc.

info@nanoviricides.com

Public Relations Contact:

ir@nanoviricides.com

[1] Yegorov S et al., Effectiveness of influenza vaccination to prevent severe disease: a systematic review and meta- analysis of test-negative design studies, Clinical Microbiology and Infection, https://doi.org/10.1016/j.cmi.2025.09.023.

SOURCE: NanoViricides, Inc.

View the original press release on ACCESS Newswire